Starting a new business is an exciting journey, but the path from a great idea to a grand opening is paved with questions. One of the most urgent and often confusing questions is: how much does it cost to start a business in the Inland Empire? If you’ve tried searching for a straightforward answer, you’ve probably been met with complicated government websites, a sea of PDFs, and vague estimates written in confusing legal jargon. This process can feel overwhelming, leaving you less certain than when you started. It’s frustrating when all you need is a clear number to build your budget and move forward with your vision.

Table of Contents

You’re in the right place. We understand that entrepreneurs in the Inland Empire are busy building their dreams, not deciphering bureaucratic fee schedules. This guide will break down the real costs you can expect, from mandatory city fees to the essential tools you’ll need to succeed. We’ll give you a realistic picture of your business startup costs California so you can plan with confidence and avoid unwelcome surprises.

Understanding the Core Costs: Essential vs. Variable

The total cost to launch your business in the Inland Empire can be split into two main categories. Understanding the difference is key to smart budgeting, as it separates the costs of being legal from the costs of being competitive.

- Mandatory Government Fees: These are the non-negotiable costs required by the city, county, and state to operate legally. Think of these as the foundation of your legal operation; they are fixed, predictable, and must be paid to get your doors open. Failing to pay these can result in fines and forced closure, so they are the absolute first priority in your budget.

- Operational Startup Costs: These are the variable expenses for tools, services, and resources that depend on your specific industry and business model. This category includes everything from software and insurance to marketing and professional advice. This is where your unique business strategy comes to life, and where smart investments can create a significant competitive advantage and set the stage for future growth.

Let’s look at each category in detail to understand exactly how much it costs to start a business in the Inland Empire.

Mandatory Government Fees: The Non-Negotiables

These are the first hurdles to clear and form the baseline for your startup budget. While they are required, they are often the most straightforward costs to calculate once you know where to look. These fees ensure you are compliant with local and state regulations from day one.

City of Ontario Business License Cost

Every business operating within the city limits, whether from a commercial storefront or a home office, must have a City of Ontario Business License. This is your official permission to conduct business and a critical first step in establishing your legitimacy in the local community.

- Application Fee: There is typically a one-time, non-refundable application fee when you first apply. This fee covers the administrative cost for the city to process your paperwork, conduct any necessary reviews (like zoning checks for home-based businesses), and enter your business into their system.

- License Tax: The primary cost is the license tax itself, which is a fee for the privilege of operating in the city. It’s an investment in the city infrastructure that supports your business. It can be calculated in a few ways depending on your business type:

- Gross Receipts: Most service, retail, and professional businesses pay a rate based on their projected annual gross receipts. This is a common method because it scales the fee according to the size and revenue of the business.

- Flat Rate: Certain professions already licensed by the state (like contractors or cosmetologists) may pay a flat annual fee, as the state has already handled a significant portion of the professional vetting.

- Per Unit/Employee: Other business models, like rental properties or taxi services, might be based on the number of units or employees. This method links the fee to the business’s physical footprint or impact on city services.

For a new small service or retail business, you can generally expect the initial Inland Empire business license cost to range from $75 to over $300 for the first year, depending heavily on your revenue projections and business category. It’s always a good idea to check the city’s official website for the most current fee schedule before finalizing your budget.

Fictitious Business Name (FBN) Statement

Are you planning to operate your business under a name that isn’t your legal last name (e.g., “Inland Empire Web Design”)? If so, you must file a Fictitious Business Name (FBN) Statement, also known as a DBA (“Doing Business As”). This is a crucial step for transparency, as it informs the public of the real person or entity behind the business name.

This is filed with the San Bernardino County Clerk. The purpose is consumer protection, creating a public record of who owns the business. Costs include:

- Filing Fee: Typically around $50 – $60 for the first business name and owner.

- Newspaper Publication: After filing, you are legally required to publish the FBN statement in a local, county-approved newspaper for four consecutive weeks. This can cost anywhere from $50 to $150, depending on the publication. The county clerk’s office can provide a list of approved newspapers to simplify this step.

Business Structure Registration

If you are forming a Limited Liability Company (LLC) or a Corporation to create legal separation between your personal and business assets, you will have filing fees with the California Secretary of State. This is a critical step for liability protection.

- LLC Filing: $70 to file your Articles of Organization.

- Corporation Filing: $100 to file your Articles of Incorporation.

Remember that LLCs in California are subject to an annual $800 franchise tax. This minimum tax is paid to the Franchise Tax Board and is a notorious part of the business startup costs California that often catches new entrepreneurs by surprise. The good news is that for new LLCs, this tax is waived in the first year, but you must budget for it in all subsequent years of operation.

Common Startup Expenses: Planning Your Budget

Beyond government fees, you need to budget for the tools and services that will make your business run smoothly and professionally. These are investments in your efficiency and brand image.

Professional Services (Legal and Accounting)

While it might be tempting to save money by handling everything yourself, consulting with a lawyer or accountant early on can prevent costly mistakes. An attorney can review your formation documents or client contracts, while an accountant can help you set up your books correctly and advise on tax strategy. Investing in professional advice upfront is often cheaper than fixing problems down the road. Budget $300 – $1,000 for initial consultations to ensure your business is set up on a solid legal and financial foundation.

Business Insurance

General liability insurance is a must-have. It protects your business from claims of bodily injury, property damage, and other common risks that can occur during business operations. Without it, a simple accident could jeopardize your personal assets. For most small businesses, you can expect this to cost $400 to $1,200 annually. Depending on your industry, you may also need professional liability (Errors & Omissions) insurance, which covers claims of negligence related to your professional services.

Technology and Software

In today’s market, you’ll likely need a website, an email address, a way to schedule appointments, a method for sending invoices, and a system to track your customer interactions. Juggling multiple apps for each of these tasks creates “subscription fatigue” and wastes valuable time switching between platforms. This is why we built “I Love My CRM”—to consolidate your leads, appointments, and messages into one dashboard. An integrated system not only simplifies your workflow but also presents a more professional and organized image to your clients, saving you up to 30% of your workweek.

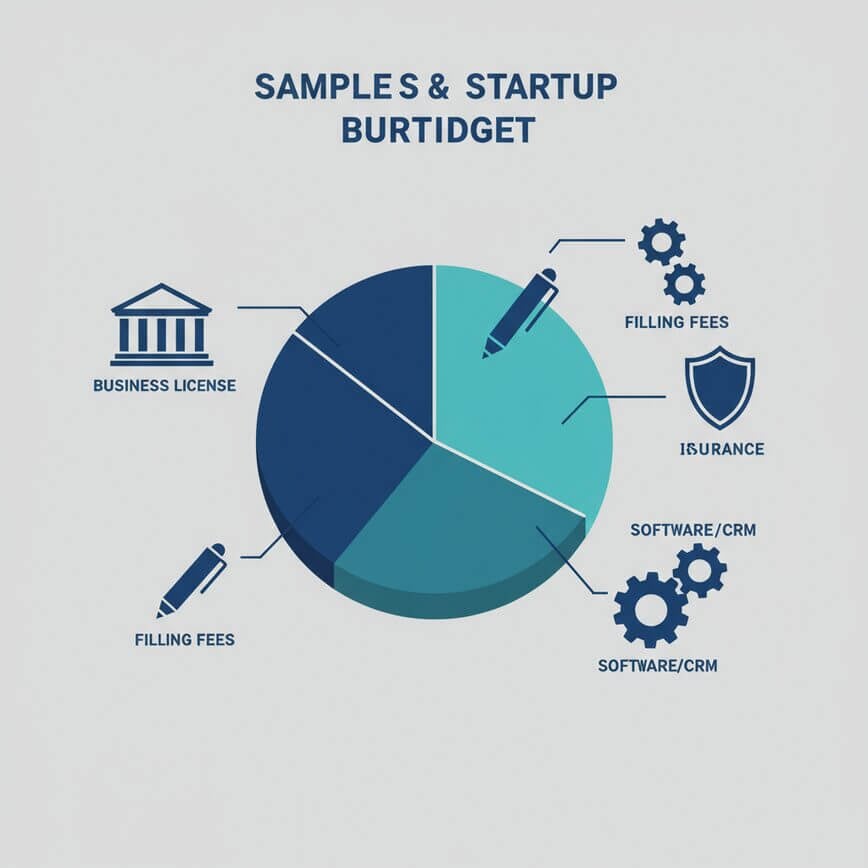

Putting It All Together: A Sample Budget

Here’s a sample breakdown of how much it costs to start a business in the Inland Empire for a home-based service provider. This illustrates how the mandatory and operational costs come together to form your initial investment.

| Item | Low-End Estimate | High-End Estimate |

|---|---|---|

| City Business License | $75 | $300 |

| FBN Filing & Publication | $100 | $210 |

| LLC Filing Fee (Optional) | $0 | $70 |

| Professional Consultation | $300 | $1,000 |

| All-in-One CRM Software | $97 | $297 |

| Estimated Total | $572 | $1,877 |

Beyond the Startup Phase: Ongoing Costs to Consider

Your initial startup costs are just the beginning. To build a sustainable business, you must also plan for these recurring expenses.

- Business license renewals: This isn’t a one-and-done fee. You’ll need to pay an annual or biennial cost to remain in good standing with your local Inland Empire city and avoid penalties for lapsing.

- Software subscriptions: Your recurring monthly or annual fees for essential tools like CRM, accounting software, and website hosting are operational investments that keep your business running efficiently.

- Marketing and advertising: This is the engine for growth. Whether it’s for digital ads, social media management, or local networking events, a consistent marketing budget is necessary to attract new customers and scale your business.

- Inventory and supplies: Depending on your business, this could mean restocking products to sell, purchasing raw materials for manufacturing, or simply replenishing office supplies like paper and ink.

- Taxes: This is one of the most critical ongoing financial responsibilities. A good rule of thumb is to set aside 25-30% of your revenue for federal, state, and local taxes. Many entrepreneurs find it helpful to open a separate bank account just for tax savings.

Don’t Let Hidden Costs Derail Your Dream

Understanding the real cost to start a business in the Inland Empire is the first step toward building a resilient and successful enterprise. Budgeting isn’t just about accounting for fees; it’s about creating a strategic plan for success. By anticipating both the mandatory and operational costs, you transform uncertainty into a clear roadmap. By investing in a streamlined system from day one, you’ll not only save money on redundant apps but also look more professional, reliable, and organized to every client.